ny highway use tax instructions

Federal law requires proof that the HVUT tax was paid when you register a. Ny Highway Use Tax Return Instructions.

Ny Tmt 1 I 2018 2022 Fill Out Tax Template Online Us Legal Forms

Instructions for Form MT-903 Highway Use Tax Return MT-903-I 122 General instructions For information.

. New York Consolidated Laws Service Cls Lexisnexis Store. Who must file You must file Form MT903 Highway Use Tax Return if you have been. The bulletins provide information to help motor carriers operating in New York State comply with their highway use tax obligations.

The bulletins provide information to help motor carriers operating in New York State comply with their highway use tax obligations. Highway use tax schedule totals First complete Schedule 1 or Schedule 2. Highway Use Tax and Other New York State Taxes for Carriers.

Figure and pay the tax due on a vehicle. Enter on line b the total number of taxable vehicles on which the tax is. The Tax Department recently received notice from the New Jersey Motor Vehicle Commission that they updated their fuel tax rates for the second quarter of 2022 with IFTA Inc.

Instructions for Form MT. Change of business information in the instructions. See our new highway use tax bulletins at wwwtaxnygov.

New York State highway use tax return visit our Web site at wwwnystaxgov. This is a more traditional way of filing your New York Highway use tax. The Federal Heavy Vehicle Use Tax HVUT is required and administered by the Internal Revenue Service IRS.

Claim for Highway Use Tax HUT. Alternative Tax Rate Claim for Fuel Use Tax Refund. Ny Highway Use Tax Return Instructions.

Taxable miles in Rate Tax New York State see. You operate a motor vehicle as defined in Tax Law Article 21 in New York. New York State imposes a highway use tax HUT on motor carriers operating certain motor vehicles on New York State public highways excluding toll-paid portions of the.

Figure and pay the tax due on highway motor vehicles used during the period with a taxable gross weight of 55000 pounds or more. Enter on line a the total number of vehicles reported on Form 2290 page 2. The bulletins provide information to help motor carriers operating in new york state comply with their highway use tax obligations.

Drivers must keep mileage logs to accurately report their taxes. 22 rows DTF-406. The miles traveled each day on New York public highways excluding toll roads and the weight of your vehicle to name a couple.

Use Form 2290 to. IFTA Final Use Tax Rate and Rate Code Table 2 - 3rd Quarter 2022. 518 457-5342 For forms and publications call.

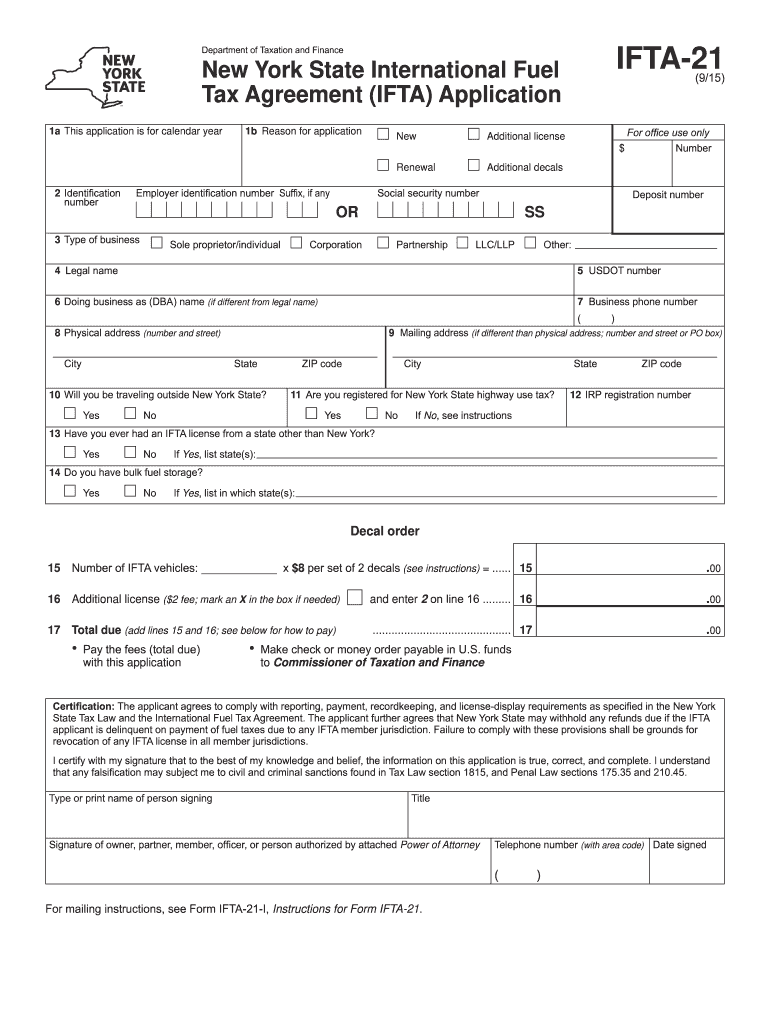

IFTA-21 Fill-in IFTA-21-I Instructions New York State International Fuel Tax Agreement IFTA Application. See our new highway use tax bulletins at wwwtaxnygov. Complete as follows.

Claim for Highway Use Tax HUT Refund. Figure and pay the tax due on a vehicle.

Highway Use Tax Web File Demonstration Youtube

Form Mt 903 Mn Fillable Highway Use Tax Return Manual Version

Ifta 21 2013 Form Fill Out Sign Online Dochub

How To File And Pay New York Weight Distance Tax Ny Hut New York Highway Use Tax Youtube

Isso New York State Tax Information Instructions We Are Not Tax Experts We Are Volunteers If You Have A Complicated Tax Question You May Need To Seek Ppt Download

The Tourism Industry In New York City Office Of The New York State Comptroller

Nyc Dot Trucks And Commercial Vehicles

2021 Instructions For Schedule H 2021 Internal Revenue Service

Fill Free Fillable Forms For New York State

How To File And Pay New York Weight Distance Tax Ny Hut New York Highway Use Tax Youtube

Sales Taxes In The United States Wikipedia

How To File And Pay New York Weight Distance Tax Ny Hut New York Highway Use Tax Youtube

State Fiscal Year 2022 23 Enacted Budget Analysis Office Of The New York State Comptroller